A comprehensive legal service for pension schemes and sponsors

The DB landscape is constantly evolving. The future and sustainability of DB schemes is rarely out of the spotlight, and new criminal and civil sanctions are set to bolster TPR’s powers to regulate.

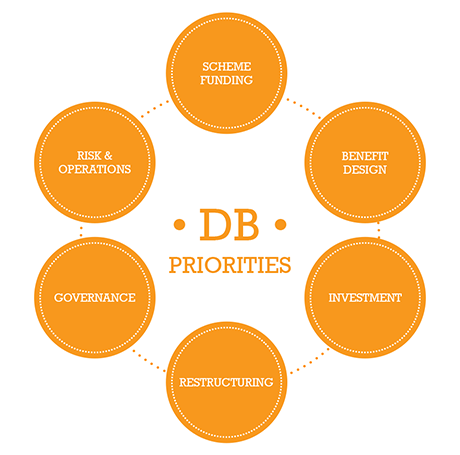

With employers and trustees having to grapple with increasing financial pressures, new legislation and regulation, there is a risk of being overwhelmed. This is where we come in. Our services are structured around six key areas, which we have identified as priorities for DB employers and trustees:

Our specialist lawyers focus solely on pensions. We have been advising trustees, employers and corporate investors on all aspects of their DB pension arrangements for over 50 years. And, we advise more of the UK’s top 200 pension funds than any other law firm. We advise on all sizes and structures of schemes, and across all industry sectors. We act for both open and closed schemes in the private and public sectors. Our involvement ranges from one-off projects and transactions to year-round scheme management including financing, investment, disputes, tax and employment issues.

Introduction TPR today published a consultation on the statement of strategy (the “Statement”) that DB trustees will need to submit as part of...

Introduction On 23 February 2024, the DWP published a consultation seeking views on proposals to make it easier to make payments from DB scheme...

Introduction The first document in the new funding regime jigsaw has now been issued in final form. Designed to implement new requirements set out in...

Introduction Among the Autumn Statement’s 110 growth measures, the Chancellor of the Exchequer, Jeremy Hunt, announced a “comprehensive package...

Katie Whitford, senior associate, is quoted as part of an article on Mallowstreet, which considers whether the case for a new DB code has stood the...

The FCA’s new consumer duty aims to set higher and clearer standards of consumer protection across financial services, requiring firms to put their...

The natural inclination is to ‘do’. It is human instinct. Do something; do anything; do everything. Never is that urge stronger than when what...

Introduction As widely trailed in the press, the Chancellor, Jeremy Hunt, delivered his Mansion House speech last night. Being guided by three golden...

The Chancellor Jeremey Hunt’s Mansion House speech took place last night, with the changes announced being guided by three golden rules, including...

Introduction On 16 June 2023, in the case Virgin Media v NTL Pension Trustees II Limited (and others), the High Court ruled on the correct...

Partner Georgina Jones gives her monthly round-up of what’s been happening in the last few weeks. “While developments have slowed a little for...

Like many pensions lawyers, I have spent much of my career talking about underfunded defined benefit schemes – section 75 debts, recovery...

Introduction On 16 December, TPR delivered its long anticipated second consultation on a new draft DB funding code. The draft code is designed to...

The UK’s Consumer Price Index recently rose by 10.1%, the highest annual inflation rate since 1982, with reports indicating this could increase...

Cost of living increases have reached levels unprecedented in recent history. CPIH rose by 8.8% in the 12 months to July 2022, the highest annual...

The DWP is currently consulting on draft regulations which set out the detail of the requirements introduced under the Pension Schemes Act 2021 for...

A question which often arises in the context of corporate transactions is whether there is a need to carry out a consultation under pensions...

Notwithstanding the current economic climate, an increasing number of schemes seem to be finding themselves with a healthy funding position and the...

Introduction Designed to implement new requirements set out in the PSA21 for DB schemes to have a funding and investment strategy (“the F&I...

For most of the past thirty years it is fair to say that if you were lucky enough to have a defined benefit (DB) pension then you didn’t need to...

“Houston, we have a problem”. Although the DC mission to help employees save up for a pension has been going well with auto enrolment, it is...

Administering occupational pension schemes is a tough gig. The past few months have seen a steady stream of new legislation which has meant...

Trustees issue lots of communications to their beneficiaries. Some are day to day comms, others are a one-off. Some go to the whole membership and...

Running a pension scheme involves making lots and lots of decisions of all shapes and sizes. Decisions which affect just one member through to...

We have responded to a DWP consultation which is seeking views on a range of policy questions relating to the creation of pensions dashboards. Read...

Cool (pension scheme) runnings – working with your administrator Administering a pension scheme is not easy and the bar keeps getting higher with...

Introduction On 16 December 2021, the PPF published its policy statement and formal levy rules for 2022/23. Click here for a PDF of this Alert. In...

Our Sackers Corporate briefing (PDF) takes a look at the latest developments in pensions for employers and corporate investors. In this briefing New...

Introduction Against the backdrop of PSA21, on 8 September 2021, the DWP published a consultation seeking views on changes to the notifiable events...

Our Sackers Corporate briefing (PDF) takes a look at the latest developments in pensions for employers and corporate investors. In this briefing...

Introduction TPR today published a consultation, which closes on 22 April 2021, on its proposed policy approach towards investigating and prosecuting...

Introduction On 25 November 2020, HMT and the UK Statistics Authority (“UKSA”) published their response to this year’s consultation on the...

Introduction On 12 November, TPR published guidance for trustees of all DB schemes, encouraging them to prepare now for the possibility that their...

At the start of the pandemic, TPR was quick off the mark to publish funding and investment guidance for trustees. It subsequently updated this in...

Claire van Rees, partner, has commented on the new guidance for trustees and employers considering a superfund, which has been published by TPR....

Introduction On 21 October 2020, TPR published guidance for trustees and employers contemplating a transfer to a DB consolidator superfund (or other...

The FCA’s consultation on advising on pension transfers has now closed and we wait with baited breath for the response; expected in early 2021. Add...

All occupational pension schemes must prepare an annual report and accounts within seven months of the end of each “scheme year”. However, on and...

Contents Our Sackers Corporate briefing (PDF) takes a look at the latest developments in pensions for employers and corporate investors. In this...

Kirsty Pake, senior associate, has commented in Pensions Expert on whether it is time for pension trustees to do more to help members, as record...

In recent years there has been a lot of discussion about consolidation of DB pension schemes. Drivers for consolidation include improving security of...

Introduction Expedited as a result of the COVID-19 pandemic, the Corporate Insolvency and Governance Act 2020 (“the Act”) received Royal Assent...

Introduction On 18 June 2020, TPR launched a new interim regulatory regime for DB consolidator superfunds (and other new models), pending the...

Today The Pensions Regulator (TPR) have published regulatory guidance for those setting up and running defined benefit (DB) superfunds. Since the...

Partner, Claire Carey, will be joining an SPP cross-disciplinary panel discussion on 24 April. Held as a webinar, the subject will be ‘COVID-19...

Partner, Faith Dickson, will be speaking at the joint Society of Pension Professionals / Association of Pension Lawyers London Evening Meeting,...

Update: On 16 June 2020, TPR published a “major rewrite” of this Guidance, designed to consolidate various strands of its guidance, to provide an...

Introduction Today, TPR published the first stage of a “major” consultation on its revised code of practice for DB funding. Running to 175 pages,...

Introduction Originally published in October (see our Alert), the Pension Schemes Bill (“the Bill”) has been reintroduced to Parliament. The Bill...

Introduction On 16 December 2019, the PPF published its final levy rules for the 2020/21 levy year. Click here for a PDF of this Alert. In this Alert...

Introduction Just in time for Easter, the Government has published its long awaited guidance on using the GMP conversion legislation to help crack...

Introduction Whilst all was quiet on yesterday’s spring statement front, and uncertainty remains on what will become of Brexit by the end of March,...

Introduction On 11 February 2019, the Government published a response to its consultation on bolstering TPR’s powers which it believes will help...

Introduction On 12 December 2018, the PPF published its final levy rules for the 2019/20 levy year. Click here for a PDF of this Alert. In this Alert...

On 7 December 2018, the DWP published its latest consultation promised by this year’s White Paper (see our Alert), setting out its proposals for a...

Introduction The High Court handed down its highly anticipated decision in Lloyds Banking Group Pensions Trustees Ltd v Lloyds Bank plc and others on...

Introduction The PPF has published a consultation and draft levy rules which set out the basis on which it intends to charge the pension protection...

This is a consolidated version of the responses submitted to the DWP using its online survey Background The DWP is seeking views on the first of the...

Introduction On 26 June 2018, the DWP published the first of the consultations promised by this year’s White Paper (see our Alert), “Protecting...

Introduction “Protecting Defined Benefit Pension Schemes”, the DWP’s long-awaited follow-up to its 2017 Green Paper on DB private sector...

Introduction As has become customary for the pensions industry, April heralds a number of changes, and 2018 is no exception. Click here for a PDF of...

Introduction On 26 February 2018, the DWP published a response to the consultation on the draft Occupational Pension Schemes (Employer Debt)...

Introduction On 19 December 2017, the PPF published its final levy rules for the 2018/19 levy year. Click here for a PDF of this Alert. In this Alert...

Introduction The PPF has confirmed that it will implement the majority of the proposals it consulted on earlier this year for third levy triennium...

Introduction On 3 August 2017, the Court of Appeal published its long-awaited judgment in the IBM case. The key issue to be decided was whether, in...

Introduction On 6 July 2017, the DWP published a response to its autumn 2016 consultation (see our Alert) on valuing pensions for the advice...

Background The DWP is seeking views on proposed changes to employer debt legislation for employers in non-segregated defined benefit multi-employer...

Introduction TPR published this year’s annual funding statement on 15 May 2017. While primarily aimed at those carrying out valuations with...

Background The DWP Green Paper on private sector DB pensions, “Security and sustainability in DB schemes”, sets out evidence about key challenges...

Introduction Back in 2015, the DWP issued a call for evidence (“the Call for Evidence”) in response to concerns about how the employer debt...

Introduction The PPF is consulting on how it intends to develop the PPF levy for the next three year period, or triennium, which starts in 2018/19....

Introduction The Pensions Regulator published new DB investment guidance on 30 March 2017. The guidance is aimed at the trustees of occupational DB...

Introduction As has become customary for the pensions industry, 6 April heralds a number of changes and 2017 is no exception. For a PDF version of...

Introduction The Government has published its response (“the Response”) to a consultation (see our Alert) on several contracting-out issues,...

Introduction On 20 February 2017, the PPF published a consultation on a levy rule for schemes without a substantive sponsor (“SWSSs”). For a PDF...

Introduction On 20 February 2017, the DWP published its Green Paper on DB private sector pensions, “Defined benefit pension schemes: security and...

Background The DWP is consulting on draft regulations, legislative review and a proposed methodology for equalising pensions for the effect of GMPs....

Background The DWP has issued a call for evidence on the way the “advice requirement” applies to members with safeguarded pension benefits who...

Introduction On 23 November 2016, Philip Hammond delivered his first Autumn Statement as Chancellor of the Exchequer. It will no doubt come as a...

It is clear that DB schemes and their sponsors are facing real challenges in the current economic and regulatory conditions. We recently surveyed...

Introduction Two consultations and a call for evidence are underway which look set to simplify certain elements of financial advice in the retirement...

Introduction As part of its work to examine how trustee boards can meet the challenge of scheme governance in the 21st century, on 22 July 2016, TPR...

Background The PLSA’s “DB Taskforce” opened a call for evidence on 9 June 2016, in relation to the challenges facing DB schemes and potential...

Background The Department for Work and Pensions (DWP) is consulting on four options aimed at helping the British Steel Pension Scheme (BSPS) as part...

Introduction On 23 June 2016, the UK voted to leave the EU by 52% to 48%. Whilst Britain, the EU and the rest of the world come to terms with what...

Introduction TPR has published its annual funding statement for 2016. Although relevant to trustees and employers of all DB pension schemes, it is...

Introduction On 23 June 2016, those eligible will be able to vote on the question “Should the United Kingdom remain a member of the European Union...

Introduction As a result of the introduction of the new single-tier state pension, DB contracting-out will be abolished with effect from 6 April...

Background Legislation to be introduced in the Finance Bill 2016 is set to include consequential changes to ensure that, following the introduction...

Introduction On 1 February 2016, the Incentive Exercises Monitoring Board (“IEMB”) published version 2 of the Code of Good Practice on Incentive...

Introduction On 17 December 2015, the PPF confirmed its levy rules for 2016/17. For a PDF version of this Alert please click here. In this Alert Key...

Introduction Integrated Risk Management (IRM) is the focus of TPR’s latest guidance. Published on 8 December 2015, it sits alongside the code on...

Background On 8 July 2015, HM Treasury published a consultation to examine whether there is a case for reforming pensions tax relief. The Government...

Career Average Revalued Earnings Schemes (known as CARE schemes) are a form of DB pension arrangement adopted by employers seeking greater costs...

A “cash balance” scheme is a form of DB pension arrangement where the defined benefit is a lump sum expressed as a formula linked to the...

Under section 75 and section 75A of the PA95, where the value at the trigger time of a DB scheme’s assets is less than a scheme’s...

A debt calculation is triggered when an employer has ceased to employ at least one person who is an active member of the scheme, and at least one...

Introduction TPR has published new guidance on assessing and monitoring the employer covenant of a DB pension scheme. Replacing TPR’s original 2010...

Section 67 of the PA95 applies whenever a power to modify an occupational pension scheme is exercised to make a change (known as a “regulated...

The Bribery Act 2010 came into force on 1 July 2011. It aims to update and simplify the UK’s anti-corruption laws. The Act creates 4 offences:...

The trustees of an occupational DB pension scheme are required to prepare, and from time to time review and if necessary revise, a schedule of...

The scheme funding provisions contained in the PA04 require trustees to prepare a statement of funding principles (SFP) for ensuring, amongst other...

Introduction Alongside the introduction of a new single tier state pension, contracting-out on a DB basis will come to an end with effect from 6...

Background On 4 March 2015, the FCA published a consultation on proposed changes to its pension transfer rules that are designed to support the new...

Background On 12 February 2015, TPR published a consultation on guidance for trustees of DB schemes on member requests for transfers from DB to DC...

Introduction The PPF is concerned that schemes have been misreporting their structure. For this reason, all schemes that have identified themselves...

Introduction On 4 March 2015, the DWP published a response to the consultation on the Occupational Pension Schemes (Power to Amend Schemes to Reflect...

Introduction The Merchant Navy case concerned an application by the trustee (the “Trustee”) of the Merchant Navy Ratings Pension Fund (the...

Introduction With Government reforms allowing DC pension savers greater freedom and choice over their retirement options set to come into force on 6...

Introduction HMRC has published draft legislation and explanatory notes on pension flexibility and annuities for a technical consultation. The new...

Introduction On 12 February 2015, TPR published a consultation on guidance for trustees of DB schemes on member requests for transfers from DB to DC...

Introduction The DWP is consulting on technical changes to automatic enrolment with a view to further simplifying the automatic enrolment process and...

Introduction The recoverability of VAT on professional fees paid in respect of occupational pension schemes has been in the spotlight recently....

Introduction On 6 October 2014, the PPF announced that the levy estimate for 2015/16 would be set at £635 million, nearly 10% lower than the...

Introduction Last week, the Government published its response to the consultation on “Reshaping workplace pensions for future generations” (see...

Introduction The position in relation to the recoverability of VAT on professional fees paid in respect of occupational pension schemes has been in...

Introduction TPR has published its revised code of practice, Funding Defined Benefits, along with a number of connected documents. The new code of...

Introduction On 8 May 2014, the DWP issued a consultation asking for views on proposed legislative changes which follow on from the abolition of DB...

Introduction The DWP has published final Regulations following the October 2013consultation on reclassifying DC benefits in the wake of the Bridge...

Introduction The morning after the night before (the much publicised Farage/Clegg debate on Europe), the European Commission published a proposal...

Background TPR issued a consultation on DB scheme funding on 2 December 2013. The suite of draft documents on scheme funding are: the...

Background The DWP’s consultation on the draft Regulations that provide transitional, supplementary and consequential measures supporting the...

Introduction TPR published its promised consultation on DB scheme funding on 2 December 2013, setting out the principles for DB funding and how TPR...

Introduction On 19 November 2013, TPR published new guidance on asset-backed contributions (ABCs). These are also commonly referred to as...

Ten things to know now We understand that the draft Code of Practice on scheme funding is due to be published on 4 December 2013. The new...

Introduction On 7 November 2013, the DWP unveiled its plans for “Reshaping workplace pensions for future generations”. The consultation, which...

Introduction Pension liberation continues to be a major focus for pension scheme trustees faced with transfer requests from members wishing to move...

Introduction The DWP has issued regulations (“the Regulations”) which will allow trustees of schemes which provide bridging pensions to...

Background The DWP’s consultation and draft regulations seek to address defective drafting in The Occupational Pension Schemes (Employer...

Introduction The Pensions Bill 2013 (“the Bill”) was published on 10 May 2013. While its main purpose is to implement the new single tier...

Introduction TPR published its 2013 annual funding statement on 8 May 2013. This year’s annual statement is relevant for trustees and employers...

Introduction There is growing evidence of a rise in pension liberation schemes and the systematic targeting of vulnerable members. This is not new;...

Background The DWP’s consultation on The Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 (the...

Introduction Following a consultation on draft provisions at the end of 2012,1 the Government has formally published the Finance (No.2) Bill) (the...

Introduction In a Budget that generally contains little that is new for workplace pension schemes, the Chancellor has announced the introduction of...

Introduction Despite the best efforts of trustees and administrators, the misstatement and overpayment of benefits is not an uncommon event. These...

Introduction The DWP has issued its response to two 2012 consultations, together with draft legislation. Since all the changes will come into force...

Introduction The latest DWP consultation1 revisits the disclosure requirements for occupational and personal pension schemes, with a view to...

Introduction On 25 January 2013, the Government took the first steps along the road to making possible changes to the DB scheme funding regime by...

Introduction The Pensions White Paper was published yesterday1. This confirms that a flat rate state pension of £144 per week (at today’s...

Introduction CPAC was asked to consider and comment on the recommendations the ONS developed following their October 2012 consultation on changing...

Introduction On 22 November 2012, the Government unveiled its strategy for “Reinvigorating workplace pensions”. The proposals build on...

Background The DWP is consulting on draft regulations on bridging pensions whichintroduce a power for trustees of schemes which provide bridging...

Introduction Pensions trustees could be forgiven for taking a deep breath and thinking “here we go again” as the ONS consults on making...

Introduction On 4 October 2012, the DWP published a consultation on draft legislation which will introduce a limited power for trustees of schemes...

Introduction The DWP has published a consultation on changes to regulations which affect contracted-out DB schemes and bulk transfers without...

Introduction Following the publication of an industry “code of good practice” on incentive exercises (the “Code”)1 TPR has...

Introduction In November 2011, Steve Webb, the Pensions Minister, confirmed his intention to “crack down” on bad practice in relation to...

Background We note that the Government’s intended policy on CARE schemes is to allow them to be used as qualifying schemes for the purposes of...

Introduction TPR has today published the first in what is to be a series of annual statements on scheme funding. Aimed at providing guidance for...

Background Three options are proposed in on the DWP’s consultation on “Meeting future workplace pension challenges: improving transfers...

Introduction With the standard LTA reducing to £1.5 million from 6 April 2012, individuals with existing pension savings need to consider whether to...

Introduction Generally, if a company exits an underfunded multi-employer DB scheme, its share of the deficit (if any) becomes a debt due to the...

Introduction The Autumn Statement was delivered on 29 November 2011.1 Against the backdrop of the continuing economic crisis, the Chancellor,...

Introduction Having run out of time in the summer session, the Pensions Bill 2010-11 finally received Royal Assent today. The Pensions Act 2011 (the...

Introduction In July 2011, TPR issued a statement: Identifying your Statutory Employer. It reminds trustees that they should “identify and assess...

Background We note that the DWP’s consultation on employer debt, published on 28 June 2011, is aimed at addressing concerns that the Employer...

Introduction The Supreme Court’s decision in the Bridge Trustees case1 was published on 27 July 2011. It addresses the dividing line between DB...

Introduction Despite several changes over the years, many still consider that the Employer Debt Regulations1 unnecessarily inhibit corporate...

Introduction The Government has published its response to consultation on the switch from RPI to CPI for increases to pensions in payment and...

Introduction Changes to pensions tax relief have been headline news since the former Labour Government first announced restrictions in April 2009....

Background The DWP’s consultation, “The impact of using CPI as the measure of price increases on private sector occupational pension...

Introduction Published on 13 January 2011, the Pensions Bill (the “Bill”) deals with several of the changes to pensions policy announced by the...

Introduction The pensions pre-Christmas rush is in full swing. With only 12 shopping days to go, key institutions are racing to get their...

Introduction The Government published its long awaited consultation on the switch from RPI to CPI for increases to pensions in payment and in...

Introduction TPR’s guidance on “Monitoring employer support: Covenant, contingent assets and other security” (the Guidance) was finalised on 30...

Background The draft guidance issued for consultation by the Pensions Regulator on “Defined benefit multi-employer schemes and employer departures:...

Background The draft “Guidance on monitoring employer support: covenant, contingent assets and other security”, published on 15 June 2010, draws...

Introduction In June’s Emergency Budget the Coalition Government announced it intended to use the Consumer Prices Index (CPI) rather than the...

Introduction When a company exits an underfunded multi-employer DB scheme, its share of any deficit generally becomes a debt due to the trustees...

Introduction The highly anticipated judgment in the Pilots1 case was handed down today. It concerns the Pilots National Pension Fund (PNPF), a UK...

Background The Government’s consultation on the proposals and draft regulations relating to the strengthening of the administration regime for...

In this Alert: Key points What is the employer covenant? Whose covenant should the trustees assess? Assessing the employer covenant? Monitoring...

Introduction Back in June 2009, TPR issued a statement on scheme funding and employer covenant (the sponsoring employer’s legal obligations to...

Introduction When a company exits an underfunded multi-employer DB scheme, its share of any deficit generally becomes a debt due to the trustees (the...

Introduction Sackers’ Public Sector Unit has wide experience of working with organisations on the complex legal and compliance issues that face...

Background We are writing in response to the consultation on the draft The Occupational Pension Schemes (Contracting-out)(Amendment) Regulations...